Is Real Estate Still a Good Investment

Despite Higher Interest Rates?

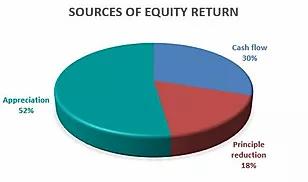

I am frequently asked if real estate is still a good investment with today’s higher interest rates and my answer is always yes. It might sound crazy, but interest rates have had little effect on real estate

returns. This is because cash flow is only one component of real estate ROI and many people are measuring returns all wrong.

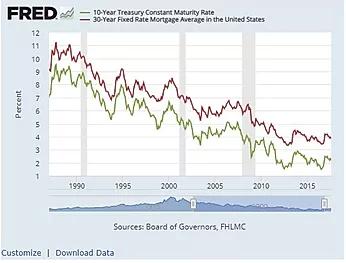

Although the financial crisis and housing crash made it very easy for investors to get in to real estate and get great returns, the extraordinary low interest rates in the 10-year period following the Great Recession of 2008 was an anomaly that did not reflect the average rate over the last 30 years. The truth is, we got spoiled. We’ve had a great run of extraordinary low rates and anyone under the age of 30 probably doesn’t realize that these low rates were not the norm. Does that mean the ride is over and real estate is no loner a good investment? Not at all. It just means that we’re returning to more normalization and although rates have risen in the last year, the fact is, they are still well below the average for the last 30 years as the chart below shows.